Invest Early and Prosper: Strategies for Building Wealth

Welcome to my article about the power of investing early for your financial future.

Investing early is one of the most powerful decisions you can make for your financial future. It’s not just about putting money away; it’s about giving your investments the maximum amount of time to grow and work for you. Many people wait until they feel financially stable before they start investing, but the truth is, that starting early—even with small amounts—can lead to substantial rewards over time.

Best Recommended and Proven Way to Make Money Online – Click HERE for Instant ACCESS >>

This article explores why beginning your investment journey as soon as possible is crucial. We’ll delve into the magic of compounding interest, choosing the right investments, balancing risk from the get-go, and crafting a long-term investment strategy that grows with you. Whether you’re just starting your career or looking to get a head start on your financial goals, these strategies will guide you toward building lasting wealth.

Now, let’s dive into the first point of our outline, discussing the importance of starting your investment journey early.

Why Start Investing Early?

Beginning your investment journey early is much like planting a seed that has the potential to grow into a towering tree over time. This proactive approach to financial planning is not merely about saving a fraction of your earnings, but about employing the most potent factor in the investment equation: time. When you start investing at a young age, you’re not just setting aside money; you’re setting the stage for exponential financial growth. Here, we explore the multifaceted benefits of early investment and how it can be the cornerstone of a prosperous financial future.

The Unmatched Advantage of Time

Embracing Market Fluctuations

One of the paramount advantages that come with starting your investment journey early is the ability to weather and benefit from the market’s inherent fluctuations. The stock market, for example, experiences its share of volatility, but historically, it has shown an upward trend over the long term. By beginning your investment endeavors early, you give yourself a broader window to navigate through these periods of volatility, thereby maximizing the potential for higher returns over time.

Harnessing the Power of Compounding

Perhaps the most compelling argument for early investment is the principle of compounding interest. This concept refers to the process where your initial investment earns interest, and this interest, in turn, earns more interest. As time goes on, the process accelerates, leading to growth that becomes increasingly rapid. The earlier you begin to invest, the more profound the impact of compounding interest, allowing what starts as a modest sum to burgeon into a significant amount.

Learning Through Experience

The Journey of Financial Discovery

Investing from a young age affords you the invaluable opportunity to learn through doing. The world of investments is vast and varied, offering a plethora of options from stocks and bonds to mutual funds and beyond. Starting early not only allows you to experiment with these different vehicles, but also to learn from the outcomes of your decisions—both good and bad. This hands-on experience is crucial for honing your investment strategies and making informed choices in the future.

Developing Financial Discipline

Another critical aspect of starting your investment journey early is the cultivation of financial discipline. Regularly setting aside money for investments teaches the importance of financial planning and prioritization. This habit, once established, extends beyond investing to influence broader aspects of financial management, including saving, spending, and budgeting.

In essence, the decision to invest early is a decision to empower yourself financially. It’s about leveraging time to your advantage, allowing the magic of compounding interest to work in your favor, and gaining valuable experience that will serve you throughout your life. Early investment is not merely a financial strategy; it’s a foundation for a secure and prosperous future.

Investopedia is a great place to expand your financial literacy.

Compounding Interest Explained

Understanding how compounding interest works is crucial for anyone looking to invest early. It’s the principle that can turn small, regular investments into a significant sum over time. This section breaks down the concept of compounding interest and illustrates why it’s often referred to as one of the most powerful forces in finance.

The Basics of Compounding

Compounding interest is what happens when your investment earnings generate their own earnings. To put it simply, it’s the interest of your interest. This might sound straightforward, but the effects over time can be astonishing.

Growth Over Time

Imagine you invest a sum of money that earns a certain percentage of interest each year. The first year, you earn interest on your initial investment. The following year, you earn interest not only on your original investment but also on the interest from the first year. As years pass, the cycle continues, with the interest that your investment earns each year adding to the base upon which future interest is calculated.

Best Recommended and Proven Way to Make Money Online – Click HERE for Instant ACCESS >>

Why It Matters for Early Investors

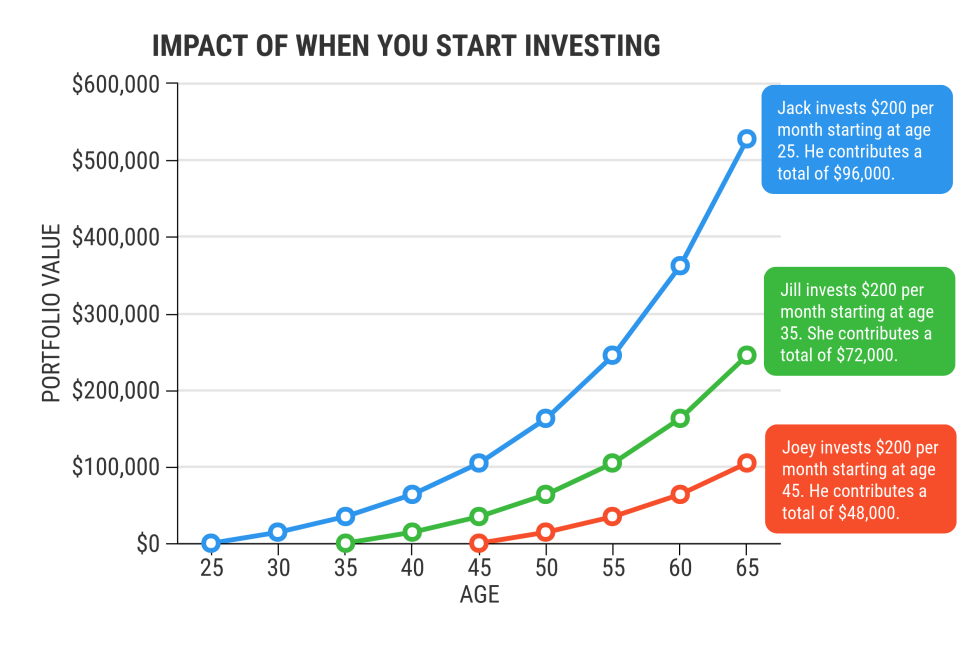

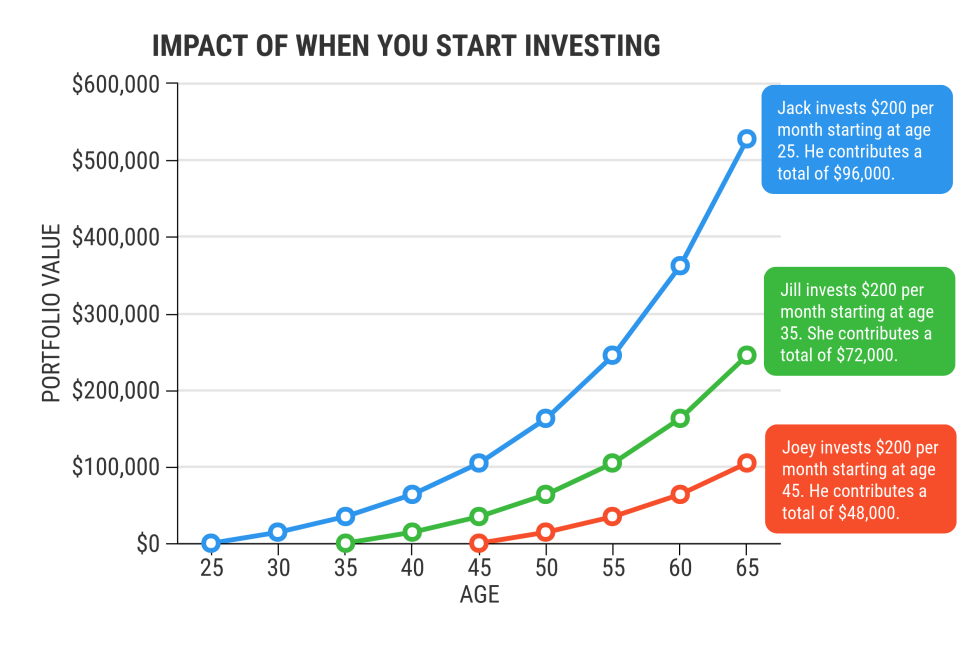

For those who start investing early, compounding interest is a game-changer. The longer your investment has to grow, the more significant the compounding effect.

Maximizing Potential Returns

Starting to invest in your 20s rather than waiting until your 30s or later can result in a dramatically different retirement nest egg. This is because each year of compounding contributes exponentially to the growth of your investment. The key takeaway is simple: the earlier you start, the more you can benefit from compounding interest.

Selecting Investments Wisely

Once you understand the power of compounding interest, the next step is to select the right investments. The goal for early investors should be to choose options that not only offer the potential for solid returns but also align with their risk tolerance and investment horizon.

Diversification Is Key

A fundamental principle for selecting investments is diversification. This strategy involves spreading your investments across various assets to reduce risk. It’s the investment equivalent of not putting all your eggs in one basket.

Types of Investments

There are several types of investments to consider, each with its own risk and return profile. Stocks, for example, offer high potential returns but come with higher risk. Bonds, on the other hand, are generally more stable but offer lower returns. Mutual funds and exchange-traded funds (ETFs) can provide a mix of stocks and bonds, offering a balanced approach to risk and return.

Risk and Time Horizon

Your risk tolerance and investment time horizon are critical factors in selecting investments. If you’re starting young, you might afford to take on more risk because you have more time to recover from any potential losses. However, it’s important to choose investments that you’re comfortable with and that align with your long-term financial goals.

In conclusion, investing early and understanding the dynamics of compounding interest can significantly impact your financial future. By selecting the right investments and employing strategies like diversification, you can navigate the investment landscape more effectively. The journey of investing is not just about growing your wealth but also about making informed decisions that align with your financial objectives and risk tolerance.

Balancing Risk Early On

When you start investing early, understanding how to manage risk is essential. This doesn’t mean avoiding risk altogether, but rather learning how to balance it in a way that aligns with your financial goals and risk tolerance. This section will guide you through the fundamentals of risk management and how to apply them from the outset of your investment journey.

Understanding Investment Risk

At its core, investment risk is the possibility of losing some or all of your original investment. Different types of investments come with varying levels of risk. Generally, investments with higher potential returns carry higher risk. As an early investor, it’s crucial to understand the types of risks involved with different investment options.

Types of Risks

- Market Risk: The risk that the value of your investment will decrease due to market fluctuations.

- Credit Risk: The risk that a bond issuer will default on payment.

- Interest Rate Risk: The risk that changes in interest rates will affect the value of your bonds.

Strategies for Managing Risk

Diversification

As mentioned earlier, diversification is key to managing risk. By spreading your investments across various asset classes, you can reduce the impact of poor performance from any single investment.

Know Your Risk Tolerance

Your risk tolerance is how much risk you’re willing to accept to achieve potential returns. This is often influenced by your investment timeframe and financial goals. If you have a long time before you need to access your investment, you might be more willing to take on higher risk for the chance of higher returns.

Regular Reviews and Adjustments

Managing risk involves regularly reviewing your investment portfolio and making adjustments as needed. This might mean rebalancing your portfolio to maintain your desired level of risk, or shifting your investment strategy as you get closer to your financial goals.

Creating a Long-term Investment Strategy

Developing a long-term investment strategy is crucial for early investors. This strategy should reflect your financial goals, risk tolerance, and investment timeline. A well-thought-out plan can help you stay focused and on track towards achieving your financial objectives.

Setting Financial Goals

Begin by identifying your financial goals. These could range from saving for retirement, purchasing a home, or funding education. Each goal will have a different timeline and may require a different investment approach.

Choosing the Right Asset Allocation

Asset allocation is how you divide your investments among different asset categories, such as stocks, bonds, and cash. The right allocation for you will depend on your risk tolerance and the time frame for your financial goals.

Staying Disciplined

One of the greatest challenges in investing is staying disciplined. It’s easy to be swayed by short-term market volatility or to chase after high returns without considering the associated risks. Staying disciplined involves sticking to your investment strategy, even when challenging market conditions.

The Role of Patience

Finally, patience is a virtue in investing. Building wealth takes time, and it’s important to remain patient and avoid making impulsive decisions based on short-term market movements.

In conclusion, starting to invest early provides a significant advantage in building wealth over time. By understanding and managing risk, and by developing a long-term investment strategy, you can navigate the complexities of the investment world with confidence. Remember, the key to successful investing is not just about how much you invest, but also how wisely you invest.

Best Recommended and Proven Way to Make Money Online – Click HERE for Instant ACCESS >>

Navigating Challenges and Setbacks

Investing early comes with its share of challenges and setbacks. It’s essential to recognize that the path to financial growth isn’t always smooth. Market fluctuations, economic downturns, and personal financial crises can test the resolve of even the most disciplined investors. However, navigating these obstacles successfully is part of what makes investing early a wise strategy for long-term financial health.

Expecting and Preparing for Volatility

Market volatility is a normal part of investing. Prices of investments can fluctuate widely over short periods due to various factors, including economic changes, political events, and market sentiment. While these fluctuations can be unsettling, they’re also an inherent aspect of the investment landscape.

Developing a Resilient Mindset

A key to managing market volatility is developing a resilient mindset. Understand that downturns are temporary and that the market has historically trended upward over the long term. Staying focused on your long-term goals rather than reacting to short-term market movements can help you navigate periods of volatility more effectively.

Building an Emergency Fund

Another important aspect of navigating challenges is building an emergency fund. This fund is a safety net designed to cover unexpected expenses or financial emergencies without needing to liquidate investments, which might not be favorable during a market downturn. Ideally, an emergency fund should cover three to six months of living expenses, providing peace of mind and financial stability.

Continuous Learning and Adaptation

Investing is a dynamic process that requires continuous learning and adaptation. Economic conditions, market trends, and personal financial situations change over time. Staying informed and willing to adjust your investment strategy in response to these changes is crucial for long-term success.

Seeking Professional Advice

For many early investors, navigating the complexities of the financial world can be daunting. Seeking advice from financial professionals can provide clarity and guidance. Whether it’s adjusting your investment strategy, understanding new investment opportunities, or managing tax implications, professional advice can be invaluable.

Embracing Setbacks as Learning Opportunities

Finally, viewing setbacks as learning opportunities is an essential part of the investment journey. Mistakes and losses can provide important lessons that improve your investment strategy and decision-making process. Reflecting on these experiences and incorporating the lessons learned can enhance your resilience and capability as an investor.

Moving Forward with Confidence

Investing early and facing the associated challenges head-on prepares you for a future of financial growth and stability. By expecting and preparing for volatility, building an emergency fund, continuously learning, seeking professional advice, and embracing setbacks as learning opportunities, you can navigate the ups and downs of the investment world with confidence. Remember, the journey to financial prosperity is a marathon, not a sprint. Patience, persistence, and a proactive approach to learning and adaptation are your best tools for achieving long-term success.

Conclusion

Embarking on your investment journey early is a step toward securing a financially stable and prosperous future. Throughout this article, we’ve explored the multifaceted benefits of investing from a young age, the magic of compounding interest, how to select investments wisely, strategies for managing risk, and the importance of creating a long-term investment strategy. Each of these components plays a crucial role in building and maintaining wealth over time.

Investing early allows you to take full advantage of time, which is an investor’s most valuable asset. With time on your side, you can see your investments grow exponentially thanks to compounding interest, navigate the ups and downs of the market with greater ease, and adjust your strategies as your financial goals evolve. Moreover, starting early fosters a habit of financial discipline, encouraging regular savings and investment, which are key to long-term financial success.

The Journey Ahead

As you continue on your investment journey, remember that patience and discipline are your allies. The path to building wealth is not always linear, and there will be periods of volatility and uncertainty. However, by staying committed to your long-term strategy and making informed decisions, you can navigate these challenges and achieve your financial goals.

Embrace Learning and Growth

Investing is also a journey of learning and personal growth. As you gain experience, your understanding of the market, different investment vehicles, and your own risk tolerance will evolve. This knowledge is invaluable, as it will help you make more informed decisions and refine your investment strategy over time.

Looking Forward

Finally, remember that it’s never too early or too late to start investing. The key is to begin as soon as possible and to remain consistent. Whether you’re just starting out or looking to optimize your current investment strategy, the principles discussed in this article can guide you toward financial prosperity.

Investing early and wisely can transform your financial future, providing not just security but also the freedom to pursue your dreams and goals. As you move forward, keep these strategies in mind, and consider seeking advice from financial professionals when needed. Your financial journey is unique, and with the right approach, you can achieve the wealth and security you aspire to.

Best Recommended and Proven Way to Make Money Online – Click HERE for Instant ACCESS >>

This concludes our exploration of why and how to invest early and prosper. By understanding the principles laid out in this article and applying them to your investment strategy, you’re taking a significant step toward financial independence and success.

Thank you for reading my article “Invest Early and Prosper: Strategies for Building Wealth”. I hope you found it informative and helpful!

For more insights into passive income, take a look at this article: Passive Income Simplified: How to Build Wealth While You Sleep